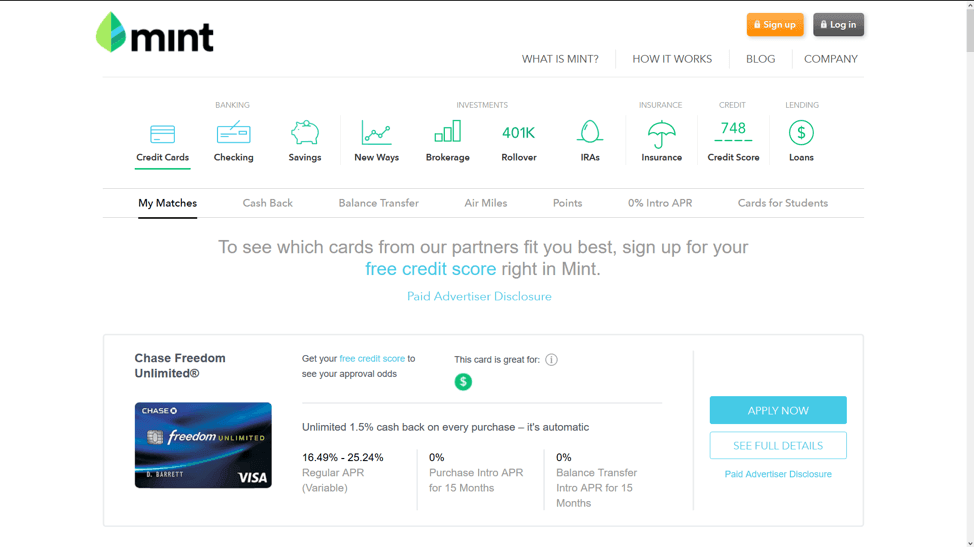

Looks like I get to have some fun in my spare time with these tasks in the coming weeks. Especially since my copy of MS Money is “on the clock,” with the online services expiring in October.For those looking for a similar overview of their financial activity across all of their accounts, competing apps such as You Need a Budget ($84/year), Simplifi ($29.99/year from the developers of Quicken, the desktop-based app Intuit spun off in 2016), and Monarch ($89.99/year) offer similar features but not the same business model.Īs in, their subscription-based business models don’t rely on mining your financial data-in anonymized and abstracted form-to generate insights to target ads.in anonymized and abstracted form-to generate insights to target suggestions for financial products. Although Intuit touts its worldwide compliance with such strict laws as the European Union’s General Data Protection Regulation and says it doesn’t disclose your data to other firms without upfront permission, privacy isn’t a big factor in Mint’s pitch.įor that matter, until the 2019 debut of the Apple Card, few financial institutions worked too hard to make that a selling point for their services.

#Quicken mint integration download

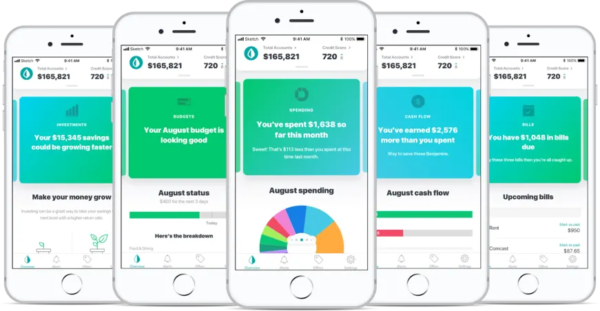

Virtualization Software: I have been a huge user of VMWare on my various machines through the years. It works quite nicely, and there is a completely capable free version. I did, however, download Sun’s VirtualBox the other day for use on my Win 7 desktop. In my coming experiment of running Windows 3.11 on Win 7, I am looking for a free virtualization solution. So, for the first time in a while, I am going to give VirtualBox a chance.My Bank: I will admit that my Bank’s online presence has greatly improved over what it was even 5 years ago. I do make use of its online billpay feature pretty extensively, and the eBill feature is not bad at all. Still, though, I have to admit that I crave that desktop experience. Also, my problem with both and My Bank, is that I have no tactile feedback for bills that are due and such. I like having a desktop application remind me somehow. Call me old-fashioned in that sense.Mint is a super easy to use financial management app that will help you keep tabs on your entire financial life, and keep everything organized within the app.

#Quicken mint integration software

: The darling of the Web 2.0 personal finance space, Mint offers a lot of the integration that I have with Money and would presumably get with Quicken. I only have two issues with Mint. For one, does not yet offer any type of bill payment scheduling like I get with Quicken or Money. The other concern–not a large one–is my fear of the “personal finance cloud.” For someone who has a lot of information in the cloud, I seem to not be too big a fan of having my personal finance information exclusively in the cloud with no local backup. I have to admit that I like having a piece of software that connects to my bank and keeps everything in sync. Below you’ll find an overview of each application as well as the features of each.To ensure that your connection transfers smoothly to the new experience, we’ve created these step-by-step instructions to make it easy for you to integrate your account.

Quicken: They clearly want the Money customers, and they are the oldest, biggest, and only player on the block. There is a limitation with how much transaction data they can convert to Quicken from Money. I also abandoned Quicken a long time ago, as I thought it getting long in the tooth–that was over 10 years ago. They are a serious contender for my software choice, and this is primarily because I really want and desire a desktop application. If you use QuickBooks, Quicken, or with our classic digital banking platform, you will need to create a new connection to make the most of the new First Service digital banking experience.Personal Finance Software: For years, I have used Microsoft Money. In the last couple of years, though, I knew its days were numbered. The official announcement of its “end of life” is here. With this announcement, my choices are fairly limited in the realm of personal finance software: Quicken,, or my Bank. My thoughts on each are below, but I crave input from others.In the coming weeks, I have some technical choices I need to make.

0 kommentar(er)

0 kommentar(er)